Wright County Commercial Real Estate Market Update — January 2026

Buffalo | Monticello | St. Michael | Albertville | Otsego | Delano

As we move into 2026, the Wright County commercial real estate market is beginning to re-activate after a quieter December. New listings are coming online, tenant conversations are picking back up, and owners are starting the year with clearer expectations around pricing, timing, and leverage.

This January update focuses on what has changed since last month, where demand is actually showing up, and what Wright County property owners should be thinking about as Q1 gets underway.

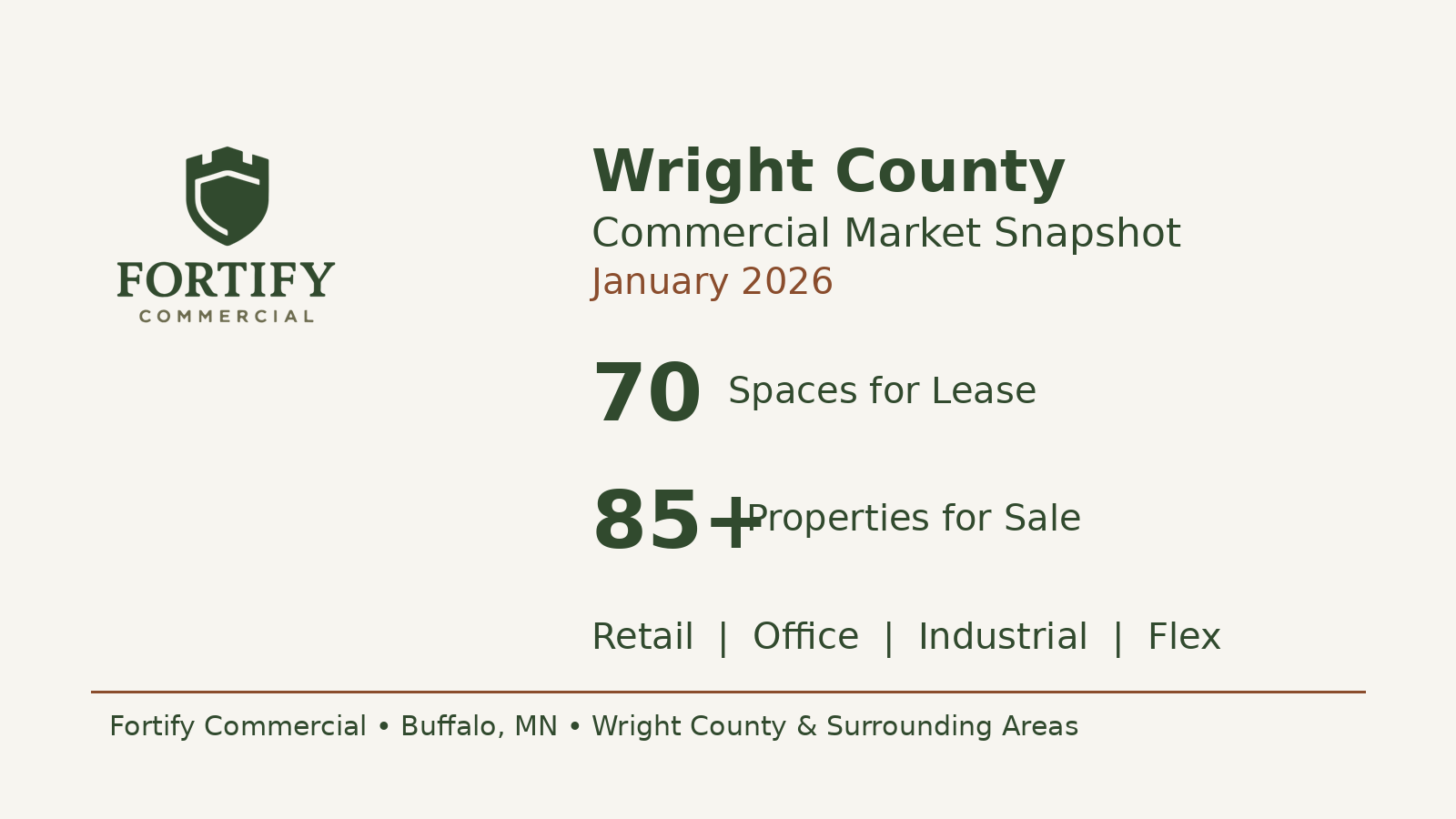

Market Snapshot — January 2026

For Lease — Approximately 70 Active Listings Countywide

Lease inventory is up modestly from December, when we were tracking closer to 65 publicly marketed spaces.

Most of the new listings coming online fall into two categories:

Office space

Older retail properties that were likely held back during the holidays

Industrial availability, particularly small-bay flex space, remains limited.

Why this matters:

Tenants have slightly more choice than they did in December, but this is not a major shift in market balance. Well-priced, functional buildings are still leasing, while dated or poorly positioned space continues to lag.

For Sale — Approximately 80–95 Commercial Properties

For-sale inventory remains fairly steady month over month.

We continue to see a healthy mix of owner-user and investor product, with the strongest interest centered on:

Small industrial and flex buildings

Mixed-use properties

Select owner-occupied office and retail assets

Commercial land listings also remain active, reflecting longer-term confidence in Wright County’s growth rather than short-term speculation.

Owner takeaway:

Buyers are active, but disciplined. Clean financials, realistic pricing, and flexibility in deal structure matter more today than they did a few years ago.

Lease Rate Reality Check

Retail

Retail asking rents generally fall in the $14–$23 per square foot range, depending on location and condition.

Prime corridors in Monticello, St. Michael, and Albertville continue to hold firm. Downtown and older retail properties without recent updates are facing more resistance.

What’s changed since December:

Retail demand hasn’t softened, but tenants are clearly choosing better buildings first.

Owner takeaway:

Retail space still leases, but presentation matters more than ever. Signage, facade condition, and visibility directly impact both achievable rent and time on market.

Office

Office asking rates remain largely unchanged, typically $12–$18 per square foot on a gross or modified gross basis.

The most consistent demand continues to be for functional office suites under 3,000 square feet. Professional users—financial services, medical, counseling, and insurance—remain active.

Larger or outdated office space is slower to lease and often requires updates or concessions to compete.

Owner takeaway:

Office leasing today is about right-sizing. Simple improvements like lighting, flooring, and paint often have a greater impact on leasing velocity than price reductions alone.

Industrial and Flex

Industrial and flex space remains the strongest segment in Wright County.

Existing small-bay space continues to lease in the $10–$12 per square foot NNN range, while new construction along the I-94 corridor is pushing closer to $15 per square foot NNN.

What hasn’t changed since December—and that’s important:

Demand remains steady, supply remains tight, and pricing is holding.

Owner takeaway:

If you own small-bay industrial or flex space, vacancy should be viewed as temporary rather than structural.

What’s Actually Moving on the Ground

Retail Activity

Retail momentum remains strongest in:

Monticello

St. Michael

Albertville

Otsego

Buffalo’s downtown and lake-adjacent areas

Tenant demand continues to favor coffee and food concepts, boutique fitness, medical, and service-based retail. These users are prioritizing visibility, parking, and walkability.

Retail isn’t disappearing—it’s consolidating into better locations and better buildings.

Office Activity

Office activity remains steady but selective.

Buffalo continues to attract professional office users, while Monticello and Delano see consistent demand for smaller suites. Owner-occupied buildings are increasingly leasing surplus space quietly, often before going to market.

What this tells us:

Office demand exists, but tenants are focused on efficiency and cost control rather than expansion.

Industrial and Flex Activity

Industrial continues to anchor the Wright County commercial market.

The strongest activity remains concentrated in:

St. Michael and Otsego along the I-94 corridor

Monticello

Delano

Demand has held steady, supply remains limited, and pricing continues to outperform other asset classes.

Key Factors Shaping Early 2026 Decisions

Several long-term drivers are influencing owner and tenant decisions early this year:

Costco construction in the Otsego/St. Michael area and associated road improvements

The I-94 expansion between Albertville and Monticello

Buffalo’s downtown momentum, including proposed housing and increased interest in adaptive reuse

Together, these projects are reinforcing Wright County’s appeal for retail, service, industrial, and mixed-use investment.

January Takeaways for Property Owners

Inventory is slightly higher, but quality space still wins

Industrial and flex owners remain in the strongest position

Retail and office demand is real, but tenants are selective

Building condition and presentation matter more than they did a year ago

Off-market movement continues quietly across the county

What Owners Should Be Thinking About Now

Early in the year is a good time to:

Re-evaluate pricing

Refresh listings and marketing

Make low-cost improvements that shorten leasing timelines

Owners who are proactive in Q1 typically outperform those who wait for spring activity to arrive on its own.

Final Thoughts

Wright County enters 2026 on stable footing. Industrial remains the backbone of the market, retail continues to adapt rather than retreat, and office leasing is defined by fit and functionality.

The opportunity this year will come from positioning, not timing.

If you’d like a property-specific look at lease rates, demand, or repositioning options for your building, I’m always happy to talk it through.

Fortify Commercial

Commercial Real Estate in Wright County and Surrounding Areas

205 2nd Ave NE, Buffalo, MN

info@fortifycommercial.com | 763-200-1440