Wright County Commercial Real Estate Market Update — February 2026

Buffalo | Monticello | St. Michael | Albertville | Otsego | Delano

February feels like the market has shifted from “January conversations” into actual decisions. Some spaces that were sitting at the end of the year are now off the board. A few new listings have surfaced. And tenants who were exploring options in Q4 are either signing or renewing.

Here’s what’s currently available across Wright County, and what it means for owners.

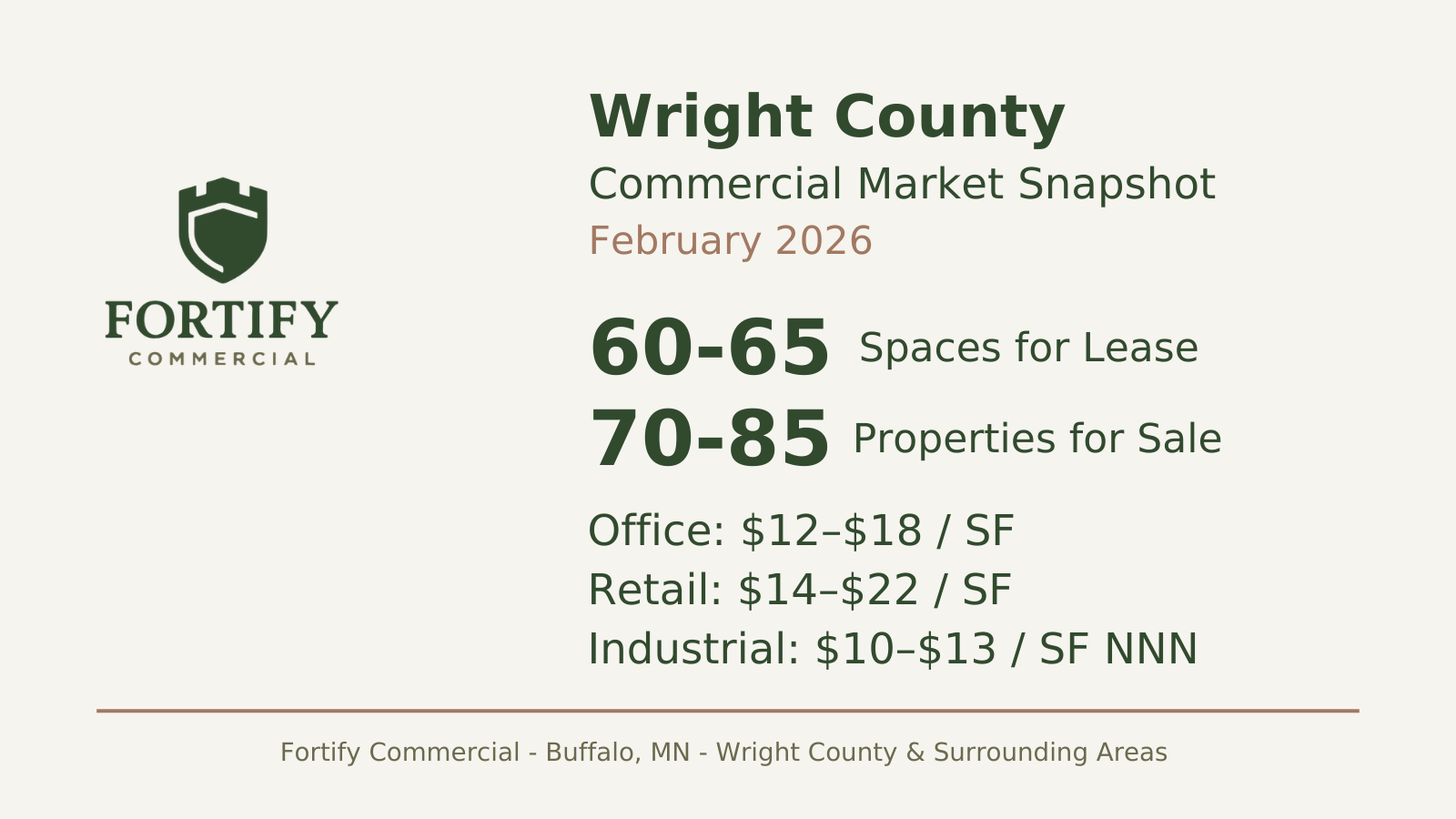

Wright County February Metrics

Market Snapshot — February 2026

For Lease — Approximately 60–65 Active Spaces Countywide

Lease inventory has tightened slightly compared to January.

The current availability skews toward:

Office space (second-generation suites in the $12–$18/SF range, mostly gross or modified gross)

Older retail units (generally $14–$22/SF depending on visibility and condition)

A limited number of industrial and flex bays (typically $10–$13/SF NNN for existing product)

The more noticeable shift this month isn’t just the count, it’s the quality mix. Some of the better-positioned spaces that were available in January have leased or are pending. In several cases, what remains are properties that either need cosmetic updates or sharper pricing.

Owner perspective:

If your building is clean, well-lit, and priced in line with these ranges, you are competing against fewer strong alternatives than you were 30–45 days ago.

For Sale — Roughly 75–85 Commercial Properties

For-sale inventory remains steady.

Pricing varies widely by asset type, but current asking ranges generally fall into:

Small industrial / flex owner-user buildings: often trading in the $90–$150 per square foot range depending on age and condition

Retail and mixed-use properties: commonly priced based on cap rates in the mid-6% to 8%+ range, depending on tenant strength and lease term

Office buildings: value largely driven by occupancy and lease rollover risk

Commercial land remains active, particularly near growth corridors and interchanges, with pricing reflecting long-term development expectations rather than immediate vertical construction.

Owner perspective:

Buyers are active, but they are underwriting conservatively. Clean leases, realistic rent assumptions, and solid expense documentation are critical right now.

What’s Moving — and What Isn’t

Office

Office remains the category with the most optionality for tenants.

Current asking rates across Wright County are generally landing between $12 and $18 per square foot, with most movement occurring toward the middle of that range.

The spaces gaining traction are:

Under ~3,000 SF

Functional layouts

Minimal buildout required

Good parking and visibility

The spaces struggling are usually:

Dated interiors

Overly segmented layouts

Suites priced at the top of the market without finishes to support it

What this tells us:

Office demand hasn’t disappeared, it has narrowed. Tenants are focused on efficiency and predictability.

If your office space has been sitting, it’s usually a presentation issue before it’s a demand issue.

Retail

Retail continues to sort itself by location and visibility.

Asking rents across the county generally range from $14 to $22 per square foot, with higher-end corridor properties occasionally pushing above that.

Strongest demand remains concentrated in:

Monticello (Hwy 25 corridor)

St. Michael / Otsego nodes

Downtown Buffalo near the lake

Retail users entering the market are typically:

Service-oriented

Medical or wellness

Boutique food and beverage

Fitness or personal services

The difference now versus a year ago is that tenants are moving deliberately. They are comparing options and choosing the building that feels easiest to open.

Owner perspective:

Retail is leasing, but average buildings are competing harder than strong ones.

Industrial and Flex

Industrial continues to be the most durable segment in Wright County.

Existing small-bay space is generally listed between $10 and $13 per square foot NNN, while newer construction in stronger corridors is testing higher numbers.

Tenants continue to look for:

Drive-in doors

Modest office buildouts

Proximity to I-94 or Hwy 12

There is still limited small-bay inventory compared to other categories. When functional industrial space hits the market at a reasonable rate, it tends to move.

Owner perspective:

Industrial vacancy should be viewed through a positioning lens, not a structural weakness lens.

Broader Factors Supporting 2026 Activity

Several longer-term drivers continue to reinforce demand across Wright County:

I-94 expansion between Albertville and Monticello

Ongoing development around the Otsego / St. Michael retail corridor

Continued residential growth

Downtown Buffalo reinvestment conversations

These aren’t short-term catalysts. They support sustained demand for industrial, retail, and service-oriented uses over the next several years.

What Has Changed Since January

Lease inventory has modestly tightened

Stronger, well-priced buildings are separating from average product

Buyers remain engaged but cautious

Asking rates are holding steady within established ranges

The overall tone of the market feels stable — not aggressive, not soft — but selective.

What Owners Should Be Thinking About Now

If you have vacancy:

Make sure your asking rate aligns with current market ranges

Invest in basic presentation before cutting price

Ensure marketing exposure is strong and current

If you’re considering a sale:

Support your price with realistic rent comps

Address deferred maintenance

Clarify lease rollover risk

Early Q1 is typically when proactive owners gain an edge over reactive ones.

Final Thoughts

February feels steady.

Industrial remains the backbone. Retail continues consolidating into stronger corridors. Office demand is narrower but still active within the $12–$18/SF band.

The opportunity this year will belong to owners who understand where their property sits within these ranges, and position accordingly.

If you’d like to walk through how your building compares to what’s currently available in Wright County, I’m always happy to dig into it.

Fortify Commercial

Commercial Real Estate in Wright County and Surrounding Areas

info@fortifycommercial.com | 763-200-1440

Available Listings

If you’re actively looking — or just curious how current inventory compares — you can view Fortify Commercial’s current listings here: