Wright County Commercial Real Estate Market Update – December 2025

Buffalo | Monticello | St. Michael | Albertville | Otsego | Delano | Annandale | Montrose

As 2025 wraps up, the Wright County commercial real estate market remains steady, healthy, and active across all major sectors — retail, office, industrial, and flex. Pulling updated data from LoopNet, Crexi, and direct owner outreach, this month’s analysis provides a hyper-local look at Buffalo, Monticello, St. Michael, Albertville, Otsego, Delano, and surrounding communities.

This report is designed for local property owners, tenants, investors, and developers who want to understand real-time activity, lease rates, development trends, and what to expect heading into 2026.

Wright County CRE Market Update

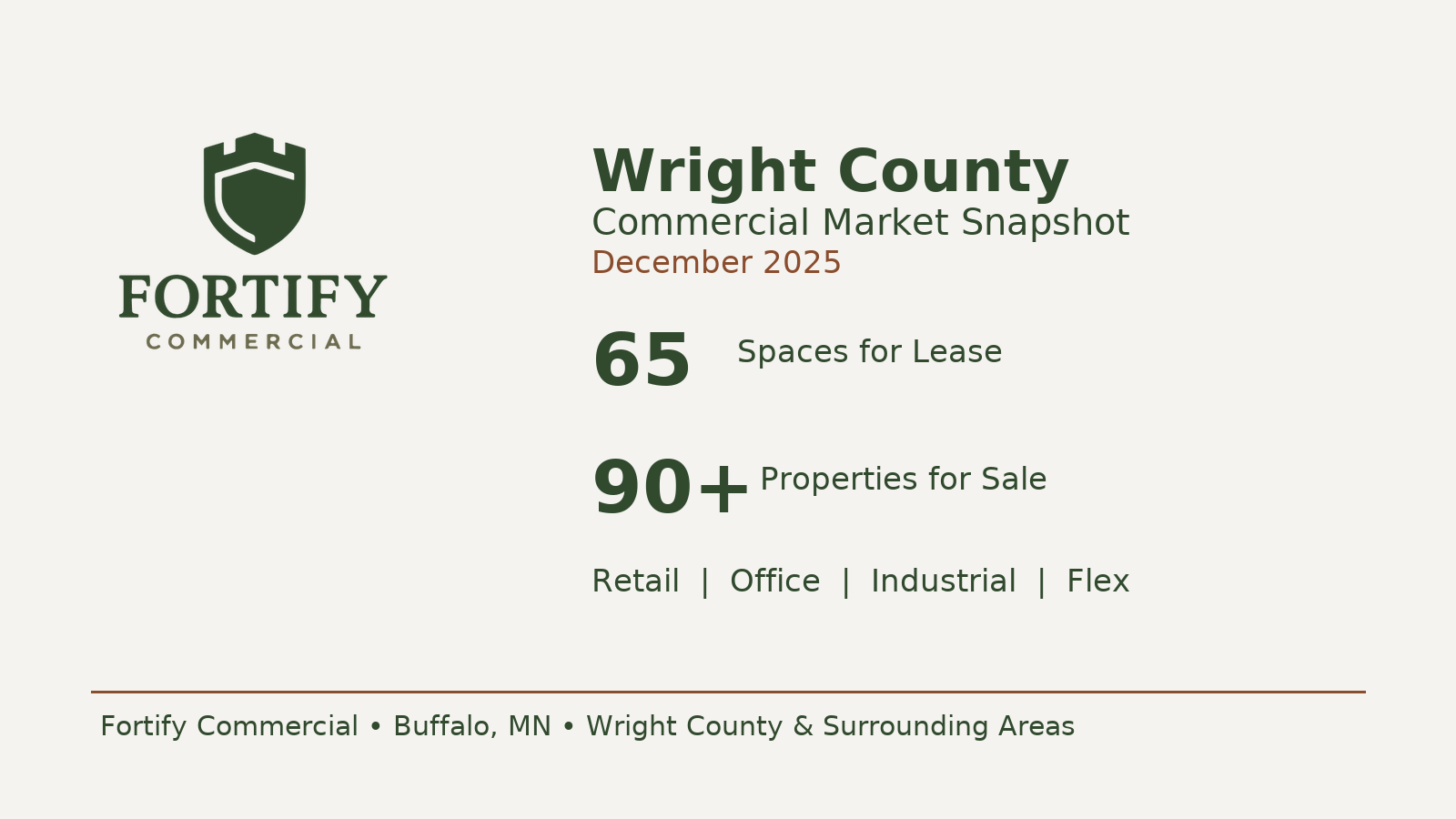

Market Snapshot — December 2025

Countywide Commercial Inventory Overview

For Lease — ~65 Marketed Spaces Across Wright County

(Down slightly from ~74 in November — consistent with year-end renewals and quieter December marketing.)

Breakdown by property type:

Retail: ~20 active listings

Office: ~21 active listings

Industrial / Flex: ~10–12 active listings

Other (medical, mixed-use, specialty): ~6 active listings

For Sale — 90+ Commercial Properties Countywide

Countywide inventory currently includes:

26+ retail buildings for sale

20+ office buildings for sale

30+ industrial properties for sale

30+ commercial land parcels across Buffalo, Monticello, St. Michael, Otsego, and Delano

Owner-user demand remains strong, particularly for small industrial flex buildings and professional office space under 10,000 SF.

Current Asking Lease Rates in Wright County (December 2025)

Retail Lease Rates

$14–$23/SF/YR (Gross or Modified Gross typical)

Prime areas (Albertville, St. Michael, Monticello Hwy 25 corridor): mid-to-upper teens

New construction & high-visibility retail: low-$20s

Older downtown or neighborhood retail (Delano, Cokato): sometimes under $10/SF/YR

Most common availabilities: 1,500–3,000 SF inline suites ideal for

boutique fitness

food/coffee concepts

medical users

service retail

Office Lease Rates

$12–$18/SF/YR (Gross or Modified Gross)

Class B/C dominates the market

$12–$15/SF/YR is the most common range

Medical, modern professional buildings & fully updated suites achieve higher rates

Suites under 3,000 SF continue to be the quickest to lease in Buffalo, Monticello, Delano & Annandale

Key driver:

Landlords updating lighting, flooring, and paint see noticeably faster inquiry volume.

Industrial / Flex Lease Rates

$10–$12/SF/YR NNN for existing small-bay inventory

$15/SF/YR NNN for planned new construction in the St. Michael/Otsego I-94 corridor

This remains the strongest asset class in Wright County.

Tenant demand is highest for:

1,200–5,000 SF flex bays

drive-in OH doors

simple office buildouts

proximity to I-94 or Hwy 12

Vacancy in this segment is typically short-lived when priced correctly.

Retail & Office — What’s Actually Moving Right Now

Retail Sector (December Recap)

Retail remains resilient across:

Monticello (Hwy 25 & I-94): new pad developments, Starbucks open, Valvoline & Fairfield by Marriott + Boulder Tap House underway

St. Michael / Albertville / Otsego: strong household growth and incoming Costco traffic

Buffalo: revitalized downtown activity near the lake; inquiries up for boutique retail, food/beverage, and walkable locations

Openings most common:

1,500–3,000 SF inline spaces with strong signage and parking.

Where vacancy persists:

Class C retail strips that haven’t renovated facades/signage.

Office Sector (December Recap)

The Wright County office market remains steady, not distressed, with strong demand for functional office suites:

Areas performing well:

Buffalo (professional, medical, financial users)

Monticello / Delano / Annandale (counseling, service office, small business users)

Notable office trend:

Owner-occupied buildings are increasingly open to leasing extra suites or second floors — often before hitting public market.

Industrial & Flex — Still the County’s Top Performer

Industrial and flex continue to lead all Wright County commercial categories.

Current Themes:

Tight supply in the 1,200–5,000 SF range

Quick absorption when listed publicly

Strong demand from tradespeople, light manufacturers, and contractors

Hotspots for Industrial Activity:

St. Michael & Otsego: Emerging I-94 industrial node with 2026–2027 new construction (multi-tenant industrial and larger distribution buildings)

Monticello: Strong driver of small-bay activity

Delano: Expansions of Northwest Industrial Park with DEED support

This category is expected to remain the strongest in Q1–Q2 2026.

Major Wright County Developments & Growth Drivers Heading Into 2026

1. Costco in Otsego/St. Michael Corridor

Under construction, projected Fall 2026 opening

Supported by major road improvements on CSAH 37, MacIver Ave & I-94 interchange

Impact on CRE:

Boosts surrounding retail, QSR, auto services, medical, and grocery-adjacent concepts

Raises land & pad values

Pulls more regional traffic from the metro

2. Buffalo Waterfront & Downtown Redevelopment

Buffalo is undergoing meaningful long-term reinvestment including:

Proposed 900+ new housing units across multiple developments

Stronger demand for neighborhood retail, walkable office, food/beverage

Growing attention on the Wright County Government Center site for potential mixed-use redevelopment

Increasing off-market movement from longtime owners

Buffalo’s downtown will remain one of the most interesting submarkets to watch into 2026.

3. Delano & Monticello — Quality-of-Life & Industrial Investment

Delano is benefiting from:

Park and riverfront redevelopment

Central Park master plan

Continued industrial expansion supported by state infrastructure funding

Monticello has invested in:

Streetscaping

Pedestrian improvements

Downtown revitalization around Walnut Street & the Mississippi River

Both cities are attracting small retail, office, and service-based tenants.

4. I-94 Expansion (Albertville → Monticello)

Six-lane expansion underway, targeting full opening by late 2026

Expected to improve freight movement, commuter flow, and visibility for industrial & hospitality uses

Key December 2025 Commercial Real Estate Trends

Small-Bay Industrial Still Outperforms

Availability remains tight and demand strong.Experience-Based Retail Growing

Boutique fitness, coffee, breweries/taprooms, and small medical operators are the most active retail tenants.Owners Who Update Older Buildings Win

LED lighting, fresh flooring, new paint — small improvements = major leasing impact.Owner-User Buildings Quietly Changing Hands

Downsizing, retirement, and consolidation continue to unlock off-market deals.

What This Means for Wright County Property Owners

Pricing Strategy

Lease rates across all sectors are stabilizing.

Overpricing leads to vacancy; underpricing leaves money on the table.

Exposure Matters

Listings with strong exposure (LoopNet, Crexi, signage, broker networks) lease significantly faster than unadvertised “quiet listings.”

Tenant Fit Is More Important Than Speed

Especially for older buildings, securing the right tenant mix is key.

Local Demand Is Strong

Buffalo, Monticello, St. Michael, Albertville, Otsego, and Delano tenants are actively seeking quality space heading into 2026.

📩 Final Thoughts – December 2025

Wright County is closing 2025 with a commercially healthy environment:

Industrial and flex remain the standout categories.

Retail is strong in growth corridors and walkable downtowns.

Office is competitive but absolutely leaseable when priced and finished correctly.

Major infrastructure and development projects will continue strengthening the region into 2026–2027.

If you’d like help evaluating lease rates, sale pricing, tenant demand, or positioning your building for Q1 2026, I’d be happy to provide a custom property analysis.

Fortify Commercial

Commercial Real Estate in Wright County and Surrounding Areas

info@fortifycommercial.com

763-200-1440